The Resilience Milestone

At first sight, resilience appears to be about:

We live in an era where complexity and ambiguity is the norm. Globalization, new technologies, and greater transparency have combined to upend the business environment and give many CEOs a deep sense of unease. Since 1980 the volatility of business operating margins, largely static since the 1950s, has more than doubled, as has the size of the gap between winners (companies with high operating margins) and losers (those with low ones). [1]

This sets the stage for the second phase - the Resilience milestone.

The prime objective of the Resilience phase is Adaptability. However, adaptability, in itself, is difficult to quantify. So we need a measure of adaptability. Let us first understand this capacity of the enterprise before determining what metric to use to measure increased adaptability.

The dictionary definition of adaptability is "the quality of being able to adjust to new conditions". It is also the "capacity to be modified for a new use or purpose". The first definition suggests a capacity to change, the second, a capacity to repurpose.

Changing large bureaucratic companies is a challenge especially since they had been designed for efficiency and scale, the very basis of their success in the past. There is tremendous inertia, a resistance to new untested ways of doing things. To encourage adaptive change, managers should be challenged to:

REFERENCES

1. Adaptability: The New Competitive Advantage; Reeves & Deimler; Jul-Aug 2011 issue; HBR

- the capacity to recover quickly from difficulties; toughness

- the ability of a substance or object to spring back into shape; elasticity

To use a boxing analogy, the definition of resilience appears to suggest that the organization gets hit, goes down for the count, then manages to get up at the count of eight and get back into the fight.

Is it just that?

From all literature, it appears that this is the most common understanding. It is also most visible in IT strategy where a lot of investment dollars are spent in securing business continuity in case of a disaster.

Market leadership is even more precarious. The percentage of companies falling out of the top three rankings in their industry increased from 2% in 1960 to 14% in 2008. What's more, market leadership is proving to be an increasingly dubious prize: the once strong correlation between profitability and industry share is now almost nonexistent in some sectors. It has even become virtually impossible for some executives to even clearly identify in what industry and with which companies they're competing.

However, the question we need to ask is whether resilience is relevant? If so, is it relevant to the frontline like sales and customer support alone? What of other functions, and at what level in the business organizational hierarchy? For example, what does resilience mean at the level of business strategy?

The answers these companies envisage all point in a consistent direction. That sustainable competitive advantage no longer arises from the position, scale and first-order capabilities in producing or delivering an offering. All those are essentially static. So where does it come from?

Increasingly, managers are finding that sustainable competitive advantage stems from the "second-order" organizational capabilities that foster rapid adaptation. Instead of being really good at doing some particular thing, companies must be really good at learning how to do new things.

It implies that companies must be quick to read and act on signals of change. They have to work out how to experiment rapidly, frequently and economically - not only with products and services but also with business models, processes and strategies. They need to build skills in managing complex multi-stakeholder systems in an increasingly connected world. Perhaps most importantly, they need to learn to unlock their greatest resource - the people who work for them.

Hence the four organizational capabilities for adaptive advantage are the abilities to:

- Read and act on signals: In order to adapt, a company must have its antennae tuned to signals of change from the external environment, decode them, and quickly act to refine or reinvent its processes, structure, skills, business model, strategies and routines.

- Possible initiatives: increased customer touch points, enhanced customer advisement and care, customer retention campaigns, loyalty programs, concentric product/service diversification, database enrichment, affiliate programs

- Possible supporting technology initiatives are: Messaging apps, KM, Data Mining, Machine Learning, AI, SMAC (Social, Mobile, Analytics, Cloud), IoT

- Develop the capacity to experiment quickly, economically: Some events or issues need solutions that can be discovered only through experimentation. All companies use some form of experimentation to develop and test new products and services. Yet the traditional approaches can be costly and time-consuming and may saddle the organization with untenable costs. Research based on customer perceptions is often a poor predictor of success. Besides, failed market-facing tests or pilots may jeopardize a company's brand and reputation.

- Possible initiatives: Employee skill enhancement and training, Models/mock-ups for controlled or virtual test environments, friendly audiences like focus groups, test user groups and online communities (owned or 3rd party), line extensions, product range experiments

- Possible supporting technology initiatives: 3D modelling, Immersive VR

- Manage complexity: Signal detection and experimentation require a company to think beyond its own boundaries and perhaps to work more closely and smartly with numerous agents, besides customers and suppliers. Industry structure is better characterized as competing webs or ecosystems of codependent companies than a handful of competitors producing similar goods and services in stable supply-demand environments. The key to complexity is to have requisite diversity.

- Possible initiatives: strategic partnerships, ecosystem development, outsourcing, offshoring, value nets, value ecosystems, parallel innovation, peer production, kanban, kaizen

- Possible supporting technology initiatives: Multi-company collaboration system, rating system, supply chain scheduling, online marketplace, online order management and payment

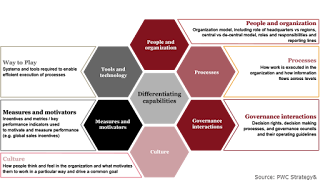

- Mobilize people: While adaptation is executed locally, its scope is necessarily global, because if the experiment succeeds, it will be selected, communicated, amplified and refined. Organizations need to create environments that encourage knowledge flow, diversity, autonomy, risk taking, sharing and flexibility that allows adaptation to thrive. Here strategy follows organization (structure) in adaptive companies and ecosystems. It is also helpful to have weak or even competing power structures, and a culture of constructive conflict and dissent.

- Possible initiatives: autonomous dynamic self-organizing structures, modular units, competing structures, cross-functional councils/boards, agile enterprise, rules of engagement, core skills/behaviours, HR policies realignment (for compensation/benefits, bonus/incentive, appraisal system)

- Possible supporting technology initiatives: Social networks, subscription group messaging, issues backlog

The first phase of the three-phase Agile Transformation program leads to the Collaboration Milestone. At this stage, the following milestones would have been achieved:

- Every team has selected a suitable Agile Methodology

- Agile software has been evaluated, selected and implemented

- Training on Agile software has been completed

- Teams have successfully migrated to the selected Agile software platform

- Team agile processes have been defined and implemented

- A bucket for new requirements (Backlog) is in place, reviewed periodically

- Requirement prioritization method has been selected and implemented

- Period review goals have been established and implemented

The focus during the first stage was on two key metrics:

- Customer Value

- Time to Market

The prime objective of the Resilience phase is Adaptability. However, adaptability, in itself, is difficult to quantify. So we need a measure of adaptability. Let us first understand this capacity of the enterprise before determining what metric to use to measure increased adaptability.

The dictionary definition of adaptability is "the quality of being able to adjust to new conditions". It is also the "capacity to be modified for a new use or purpose". The first definition suggests a capacity to change, the second, a capacity to repurpose.

Changing large bureaucratic companies is a challenge especially since they had been designed for efficiency and scale, the very basis of their success in the past. There is tremendous inertia, a resistance to new untested ways of doing things. To encourage adaptive change, managers should be challenged to:

- shift focus from traditional competitor moves and look at adjacent or analogous industries, moves made by disruptive mavericks

- set aside single business forecasts, significantly expand scope and horizon of regular or periodic assessments to identify/address the risks and uncertainties

- put an initiative on every risk, that is, either by responding to a neglected business trend, creating options for responding to it down the line, or learning more about it while being disciplined about metrics, time frames, responsibilities, entry and exit criteria

- examine multiple alternatives by ensuring change proposals are accompanied by several alternative courses of action in order to foster cognitive diversity and organizational flexibility

- increase the clock speed as the speed of adaptation is a function of decision cycle time, make annual planning processes lighter and more frequent, and episodic processes continual.

REFERENCES

1. Adaptability: The New Competitive Advantage; Reeves & Deimler; Jul-Aug 2011 issue; HBR

Comments

Post a Comment